They may affect exactly how sensible household security finance feel

In 2010, interest trend 2024 highly recommend rates might have to go upwards. Gurus faith simply because rising cost of living and you may financial transform. Individuals need to keep tabs on these types of fashion. Getting told facilitate individuals plan its cash top.

Calculating Your residence Collateral Mortgage

Teaching themselves to determine your house guarantee loan will help you make smart money alternatives. Units such as the wells fargo house equity finance calculator allow it to be easy. It assist residents see how much they are able to acquire by lookin on their residence’s well worth in addition to financial kept to invest.

The latest wells fargo domestic collateral loan calculator is a fantastic unit to own homeowners. It can help your work out how far you might borrow. This is how first off:

- Get into your household worth.

- Input their a fantastic financial equilibrium.

- Bring information about various other liens or financing into assets.

- Remark the fresh new projected amount borrowed the new calculator indicates according to their enters.

This easy process reveals as to the reasons it is essential to see their home’s equity. It can help you have made the most from the loan potential.

Just how to Evaluate Your own Home’s Collateral

- Carry out a relative industry installment loans in Riverside PA with bad credit research observe exactly what equivalent house was well worth.

- Hire a specialist appraisal service having a detailed look at the house’s worthy of.

- Play with on the internet valuation systems, but consider they could not particular.

These procedures are perfect for learning your residence guarantee. They provide a clear picture of exactly how much you might borrow secured on your residence.

A smooth, modern calculator towards Wells Fargo symbol conspicuously presented within best. The newest calculator screens a buck amount in the committed font, representing the home collateral loan amount. The keypad have higher, easy-to-drive buttons and you will boasts wide variety, quantitative situations, and you can basic math symbols. The back ground are an excellent gradient from chill blues and you can vegetables, giving the image a professional and you may financial become.

Certificates to have a good Wells Fargo Home Security Mortgage

It is important to understand what you need to possess an effective Wells Fargo household equity mortgage. We’ll glance at the trick issues have to have, eg good credit and you will proof of money. Getting these materials ready can help you rating a loan with finest words.

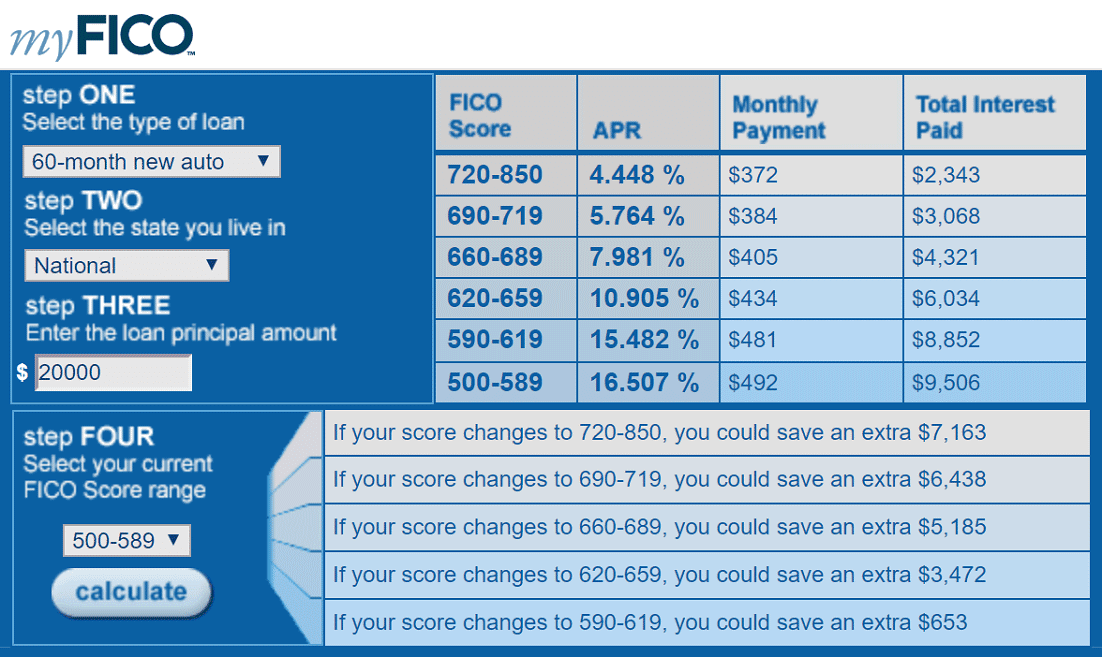

Called for Credit score to possess Approval

You desire a credit rating between a good and you will sophisticated to track down recognized. A score more than 700 is the better, giving you significantly more mortgage choice minimizing prices. Make sure to look at your credit file and you will develop any mistakes before you apply to increase the probability.

Money and you will A position Conditions

Wells Fargo would like to select evidence of your income. You might need to exhibit shell out stubs, W-2 versions, or taxation statements. That have a reliable job assists the application also. A constant money is key to get the loan as well as how far you can borrow.

Wells Fargo Domestic Security Loan Conditions

You will need to understand the wells fargo household security financing criteria when you’re thinking about this package. There are certain actions and you may documents you will want to ready yourself. This will make the method easier helping you earn ready having what exactly is next.

- Evidence of earnings, including pay stubs otherwise paycheck emails

- Taxation statements on prior two years

Which have all your documents having fund able suggests you’re economically in control. Being aware what need can you apply successfully.

Software Processes to own Wells Fargo Domestic Security Financing

Trying to get a beneficial Wells Fargo family guarantee loan is easy. It requires multiple strategies that produce the process simple. Being aware what you have to do makes it possible to get ready well. Like that, you are able to the application strong and then have this new money you need.

Leave a reply

Laisser un commentaire