Accounting Software Do Beautiful Business

Although it lets you customize invoice elements, such as invoice line items, we wanted to see some personalization in creating invoices. A/P management is one of Xero’s strongest features in our evaluation. From vendor creation to recording of payments, Xero can help in keeping your billing system organized. bookkeeping spreadsheet It also has an outstanding PO system to convert POs into bills, track unpaid bills, record e-payments, and apply vendor credits. The chart of accounts has default accounts set up, but you can modify existing accounts or add new ones. You can also invite an additional user and set limits to their access.

off for 6 months

Sprout Social is a powerful social media management tool that lets you control all of your accounts in one place. If you’re considering this software as a solution for your social media woes, you’re likely wondering what it costs. Sprout Social pricing varies depending on the plan you select and whether you pay monthly or annually. Keep reading to see what you can expect to pay to use Sprout Social. If you’re on a tight budget, then check out Wave Accounting, which offers a forever free Starter plan — yes, you read that correctly! With Xero, you can add an unlimited number of users to your account at each subscription level.

Capture data automatically

However, they were not as comprehensive as what we found in our review of QuickBooks Online. Phone support is not available immediately; you must contact customer service first via email or live chat. However, the upside is that Xero does not leave users hanging with long wait times. Instead, the company will call you back at a time convenient for you. Given that there are several invoicing software on the market, it’s worth putting in some time to research your options before choosing one for your business.

Xero Features

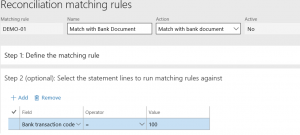

Xero does provide an account to hold undeposited checks, but the feature doesn’t track when checks are removed and deposited and doesn’t allow cash to be added to the deposit. Though such a feature doesn’t impact the overall performance of Xero that much, not being able to group payments into bank deposits makes it difficult to reconcile your bank account. Xero’s banking and cash management features score high in our evaluation because they include all the functions we want to see in accounting software. We like the side-by-side layout when reconciling transactions because it’s easy to match transactions and spot bank statement items that haven’t yet been recorded. Xero lets new customers sign up for a 30-day free trial to test out its features.

Included in the Growing plan

This is beneficial to small businesses that need multiple people to be able to log into the accounting software and don’t want to pay extra or upgrade to get more seats. These reports help small business owners identify areas for improvement and make evidence-based decisions in real time. Xero doesn’t offer as many pre-built reports compared to Xero alternatives such as QuickBooks. Yes, you can, as Xero has Android and iOS mobile apps that allow you to access your account and manage your finances. However, it is not the most comprehensive mobile app because it doesn’t allow you to generate reports, receive payments from customers, or record time worked. Check out our guide to the best mobile accounting apps for our top picks.

Why You Can Trust Fit Small Business

We collect the data for our software ratings from products’ public-facing websites and from company representatives. Information is gathered on a regular basis and reviewed by our editorial team for consistency and accuracy. accounts receivable common term and definition Wave is a solid choice for small businesses looking for free accounting software. We really liked Xero’s unique History & Notes feature, which presents an activity report at the bottom of every transaction screen.

Another option is Wave, which is a free accounting software program that includes invoicing, payroll, double-entry and sales tax tracking. Whatever your needs, there’s sure to be an accounting software program that’s a perfect fit. For example, when you purchase the Pro Plus Desktop plan, you can have up to three concurrent users but each of those users must pay for their own account (at $349.99 each per year).

Being legally compliant and professionally managing your finances will help you claim any tax relief you’re entitled to. You may need to show your financial statements to funders or to access certain tax benefits. Make sure you manage your finances to make sure they’re compliant. As suggested by its name, social advocacy groups are set up to advocate a social issue or cause. They may promote the causes of large groups of people, like human rights organizations, or smaller sections of society, like anti-semitism campaign groups. This is often done by arts organizations, professional associations, and other types of nonprofits to fund their services, such as a dog shelter charging an adoption fee to a prospective owner.

The Online plans start at $30 per month, whereas the Desktop plans must be paid annually and start at $492 per year. QuickBooks is a popular accounting software used by small businesses, solopreneurs and freelancers. The software helps users to keep track of their finances, customers and vendors. This is because QuickBooks was designed for small businesses that might not have an accounting background, whereas Xero was designed with accountants and bookkeepers in mind. QuickBooks is also better for businesses that need to track inventory, as it has built-in inventory management features.

The best accounting software received top marks when evaluated across 10 categories and more than 30 subcategories. In the Early plan, the least expensive subscription, you can send up to 20 invoices and schedule up to five bill payments only. For unlimited invoicing and bill-paying capacity, you’ll need to upgrade to the Growing plan. Xero’s pricing compares favorably with other accounting software we reviewed. Popular alternatives, such as FreshBooks and QuickBooks Online, cost at least $18 monthly without introductory discounts.

Not every accounting software provider offers a free trial, so we appreciate this feature. Unlike many other accounting applications, Xero does not base its pricing on the number of individuals who need access. In our view, this is one of Xero’s key differentiating factors, making it a great choice for growing businesses that are rapidly adding new employees.

†Xero customers who use online invoice payments get paid up to twice as fast than those who don’t use online invoice payments. With online invoice payments through Stripe and GoCardless, you can accept payments by card or direct debit. If you’re not happy with the plan you signed up with, you can switch to a different plan throughout the trial to test out the different levels and see what you’re missing. For an additional $50, add a Bookkeeping setup with a Live Bookkeeper.

- FreshBooks charges $17 per month and QuickBooks charges $30 per month).

- Run things smoothly, keep tidy online bookkeeping records, and make compliance a breeze.

- Instead, the company will call you back at a time convenient for you.

- One cool new Xero feature is its beefed-up Inventory Plus management system.

As a business moves into higher-growth phases, it will likely require more integrations to scale up and keep things running smoothly. Xero offers pricing plans to suit businesses of different sizes and stages. In addition, Xero accounting and bookkeeping partners operating cash flow calculation can offer bare-bones plans for businesses that need only the basics. We’re upfront about pricing, and provide full details of our pricing plans and optional extras. For Payroll with Gusto (US), pricing is based on the number of users who are paid each month.

We recommend Xero for companies that are rapidly adding employees and don’t want to worry about the number of people at the organization using the product. Xero’s online accounting software for nonprofits can help simplify your accounting processes, from keeping track of cash flow and paying your employees, to sharing financial reports. You’ll have more time to set up and manage a successful nonprofit. Unlike many other competitors that cap the number of users per plan (looking at you, QuickBooks), Xero offers unlimited users even on the lowest tier plan.

To keep things organized, Xero logs every action users make and compiles the history of every transaction. Xero’s customer service scores 4.3 out of 5 on Trustpilot, with many users praising the fast response time. This is ideal for growing businesses that don’t want to waste time on technical issues. Xero partners with Gusto to add more HR functions, such as payroll services. With Gusto, you can onboard new hires, administer employee benefits, track hours and paid time off, run payroll, and automatically file payroll taxes.

Leave a reply

Laisser un commentaire