6 Best Cloud Accounting Software of 2024

These experiences enriched her understanding of small business management and marketing strategies. Today, she channels this first-hand knowledge into her articles for Forbes Advisor. You can set up a dashboard displaying important financial information like who owes you money, what bills are due, in what state is your cash flow, and so on. Zoho Books takes a different approach, allowing you to add more users by charging you $2.5 per user per month. Through the use of online donation tools, custom communications, donor database reports, and event registration capabilities, Aplos allows you to fundraise more effectively. In Kashoo, all transactions that occur in your business are automatically categorized and sorted with the smart inbox feature recognizing the vendors you usually do business with and keeping track of all activity.

Xero at a Glance

The defect caused any Windows computers that Falcon is installed on to crash without fully loading. Additional reporting by Imran Rahman-Jones, Liv McMahon and Tiffany Wertheimer. Each of those customers is a huge organisation in itself, so the number of individual computers affected is hard to estimate.

Useful features to run your business

While, with most accounting software, you must generate a new report after choosing from a list of reports, the reports list in Zoho Books already has all data populated in each report. However, once I became more familiar with the software’s layout, completing tasks required no learning curve, even when setting up advanced actions such as automations. For example, to add a new project, I clicked “time tracking” on the left-hand menu, then the “projects” submenu item. From there, I could click “+New Project” at the top of the resulting screen and fill out a simple form to add my new project.

Boost your small business accounting knowledge

In 2023, she was named the No. 2 Most Influential Financial Advisor in the Investopedia Top 100. Once I finished answering the setup questions, I was is inventory a current asset given access to the platform. The first screen I saw was the “all files” screen, which allowed me to see any files I had stored in my Neat account.

Although you can track expenses, QuickBooks Simple Start doesn’t enable users to pay bills. With your accounting software and data stored online in the cloud, you can access your up-to-date accounts anywhere there’s an internet connection. Your Xero data is backed up regularly and protected with multiple layers of security. FreshBooks has a 4.5 rating on Capterra with 4,379 reviews and a 4.5-star rating on G2 with 688 reviews. Users say it is extremely easy to use and has all the basic features needed to manage small business accounting needs. However, they say the platform could use more automations and more in-depth reporting.

- I could navigate to the “invoices” menu item, then to the “sales” submenu item to view a list of all existing invoices.

- Along with invoicing, you can check your company’s financial information anytime from the office, your home, or even in line at your favorite coffee shop.

- Get the most out of Xero with access to our team of onboarding specialists during your first 90 days.

- Generally, though, you’ll access your software from your phone or computer, and you’ll connect or enter your financial information into it so you can budget, plan, and/or invest.

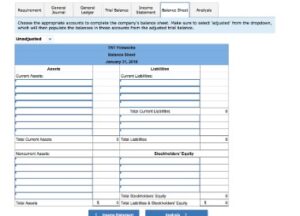

Privacy watchdog says it’s ‘surprised’ by Elon Musk opting user data into Grok AI training

Moreover, I had to click around to learn how to access convenience features that made my user experience much easier, such as the “+” button at the top of my dashboard that can be used to access common action items. Xero and FreshBooks are frequently highlighted for their user-centric design and intuitive functionalities. Xero has a fairly comprehensive feature set, which provides expense management, bank reconciliation, and multi-currency accounting. We like that Xero has over 12 branches of accounting 50 pre-built report templates, covering financial statements like profit and loss, balance sheet, aged receivables/payables, and cash flow. Invoice customization is slightly limited compared to QuickBooks Online or FreshBooks – you can only make content changes and minor tweaks to page margins, fonts, logos, columns, and fields. QuickBooks Online also has many features to simplify billing, including mobile optimization, payment buttons, recurring invoices, and reminders.

For example, when you click “projects,” you are given the option to go to your list of projects or a report of staff cost rates. This tool allowed me to start a timer and allocate the time to a client or project and even specify the tasks worked on during the logged time. At the top of this time tracking screen was a “generate invoice” button that allowed me to bill for logged how to determine the cost per unit chron com time by quickly finalizing an invoice that was already almost completely pre-populated with necessary information. After creating the project, I was taken to a page designated to that project. Here, I could post updates on the project’s status, track hours worked and view project invoices, estimates, expenses and profitability reports, all from the project’s page.

From there, you can easily retrieve documents to attach to invoices as necessary. Striven can generate a wide span of financial reports, including cash flow, balance sheets, and profit and loss statements. It can also generate custom reports, automate invoicing, send reminders, and manage vendor bills electronically. However, Striven might not be the best fit if your company needs complex tax calculations or advanced budgeting and forecasting support.

Now you need to invest hours tracking down different spreadsheets and manual data entry to get a grasp on how your business is performing. Access your books, anytime, anywhere, so you’re always on top of your business’s financials. Small businesses may be able to find a less expensive basic plan, while larger businesses may need to upgrade to a more expensive standard or premium plan. All this to say, each step provided clear links or buttons to walk me through each subsequent step. Steps were intuitive to complete with simple forms, toggle buttons and drop-down options.

While 20% of cloud users claim disaster recovery in four hours or less, only 9% of non-cloud users could claim the same. In a recent survey, 43% of IT executives said they plan to invest in or improve cloud-based disaster recovery solutions. If your business has two employees or more, then you should be making collaboration a top priority. After all, there isn’t much point to having a team if it is unable to work like a team. Team members can view and share information easily and securely across a cloud-based platform. Some cloud-based services even provide collaborative social spaces to connect employees across your organization, therefore increasing interest and engagement.

Another feature we like about Zoho Books is its client portal, which is unavailable in most of the other software we reviewed. This feature helps improve communication with your clients as it allows them to track their transactions and interact with you in real time through comments. Cloud-based accounting software is just like traditional accounting software with the exception that all the data is hosted on remote servers instead of the user’s desktop computer. The cloud-based accounting service is one of the most widely used accounting products in the United States.

With all three sources of information conveniently available in one place, Clio makes it quick and easy to reconcile and access current or past reports for compliance purposes. Business owners, freelancers and entrepreneurs often spend a large chunk of time on administration and accounting. Suited for small- and medium-sized businesses (SMBs), Xero is an affordable cloud-based accounting software system that streamlines these processes with plans starting at $13 per month. Check out the Xero App Store to find, try and buy business apps that connect easily to Xero online accounting software. Apps like Stripe, GoCardless, Shopify, and WorkflowMax connect seamlessly and sync data with Xero business accounting software. Neat offers several key features, including extensive document management features, its patented optical character recognition (OCR) software and its mobile application.

This information is encrypted so only people with the login can view the data. Make better and faster decisions with your financial data available in real-time. QuickBooks cloud accounting software gives you an up-to-date and accurate view of your cash flow with bank balances, transactions and financial reports instantly available.

Xero is a good choice for small businesses that are looking for an accounting software with payroll capabilities. The software is also a good fit for businesses that are growing quickly and need to track projects and organize their documents efficiently. For example, when trying to find which menu option allowed me to manage my invoices, I assumed this feature would be found under the “accounting” top menu.

She’s well-versed in the intricacies of LLC formation, business taxes, business loans, registered agents, business licenses and more. These options were also always available to me wherever I was in the platform via a slide-out left-hand menu. I simply had to input my email, name and phone number into a simple sign-up form. Once I finalized the invoice, I could click the “send to” button at the top of the invoice and input an email address, a subject and a message to send the invoice. Or, I could click “share via link” to generate an invoice link sendable via text, social media or some other communication channel. Zoho Books is ideal for small-to-medium-sized businesses (SMBs) that want to take advantage of the platform’s large extensive business ecosystem.

The comprehensive package includes help with accounting, invoicing, payroll, benefits and expense-tracking needs. Xero is a great option for large teams and SMBs looking for accounting software that multiple team members can use. Freelancers and entrepreneurs who want an affordable plan might want to look elsewhere simply because of its basic plan’s limitation on the number of invoices. Freshbooks is a tool that allows you to give your accountant the permissions to access your dashboard, invoices, expenses, reports, and accounting. However, as your business expands, you will want your accounting software with inventory management, that can manage vendors and assist you with purchase ordering when selling more products.

Once pressed, a drop-down menu offers common action items, such as adding an invoice or a bill. Simply click on the option to be taken to a page that walks you through the process to complete the task. Many cloud accounting platforms offer free trials, and some also offer forever free plans that allow for more extensive testing without a time limit. If you have questions about how the platform works, schedule a demo call with the sales team so that an expert can walk you through the software. When searching for the best cloud accounting software for your needs, set your budget and make a list of your must-have features. Also consider whether you want to choose an accounting software that can scale with your needs for many years or if you’re okay with choosing something that works for now and potentially switching platforms later down the line.

Leave a reply

Laisser un commentaire