Chase Bank HELOCs try unfortunately no further given

Pursue HELOCs are not any longer open to the fresh candidates

The organization may wish to reinstitute so it family equity product on one-point later however, already have not lay one timelines to make one to choice. The audience is hence showing the cash-out re-finance, a unique mortgage product that enables you to accessibility the house’s collateral since the dollars.

Does not bring old-fashioned household guarantee funds

An alternative drawback would be the fact Pursue does not have a traditional house equity financing. You can not remove a moment financial on your home due to that it institution. You might simply re-finance much of your home loan which have Pursue or take cash out https://elitecashadvance.com/payday-loans-ar/magnolia/ of your collateral in the process.

Conditions and you will eligibility criteria commonly clearly detailed on the internet

That issue with Chase’s fixed-rates house collateral financing are a lack of transparency. The company does not publish the minimum credit history requirements otherwise people other eligibility conditions. There’s also zero understanding to financing terms and conditions.

Having said that, you could potentially pre-qualify for a money-aside refinance onlinepleting the fresh new pre-qualification techniques will let you discover whether you might qualify for property equity loan out of Pursue one which just fill out an entire app.

Pursue home equity products

Chase’s domestic collateral loan products be limited than you may assume off a loan company of the dimensions and you can customers. The only most recent choice is a funds-out refinance mortgage, although the company you will definitely expand the household security brand when you look at the the long run.

Family guarantee personal lines of credit

Pursue approved HELOC apps up to 2020 if this paused the fresh providing considering the COVID-19 pandemic. Since then, at least one exec provides hinted that business is given providing right back the merchandise. Yet not, there were no indications this particular will come any time in the future.

Cash-aside refinance funds

Really the only household collateral mortgage option one Chase has the benefit of now was its bucks-away re-finance loans. This type of involve refinancing your own full top mortgage therefore, the words and you can rates you’d previously is changed of the a separate home loan from Pursue. In the process of refinancing your home having Chase, you could tap into a number of the security which you have gathered.

Cash-away refinances might be advantageous when your current financial provides a highest repaired interest rate than you prefer. It allow people to take benefit of developments in their creditworthiness so you can safer all the way down rates of interest whilst opening initial dollars from equity.

not, this will be a double-edged blade. Even when you happen to be happy with your current loan terminology and you may desire price, they will still be reset for individuals who recognized an earnings-aside re-finance regarding Chase (or other business). If you’d like to keep your prie, consider contrasting the best household collateral money from other company.

Chase financing rates

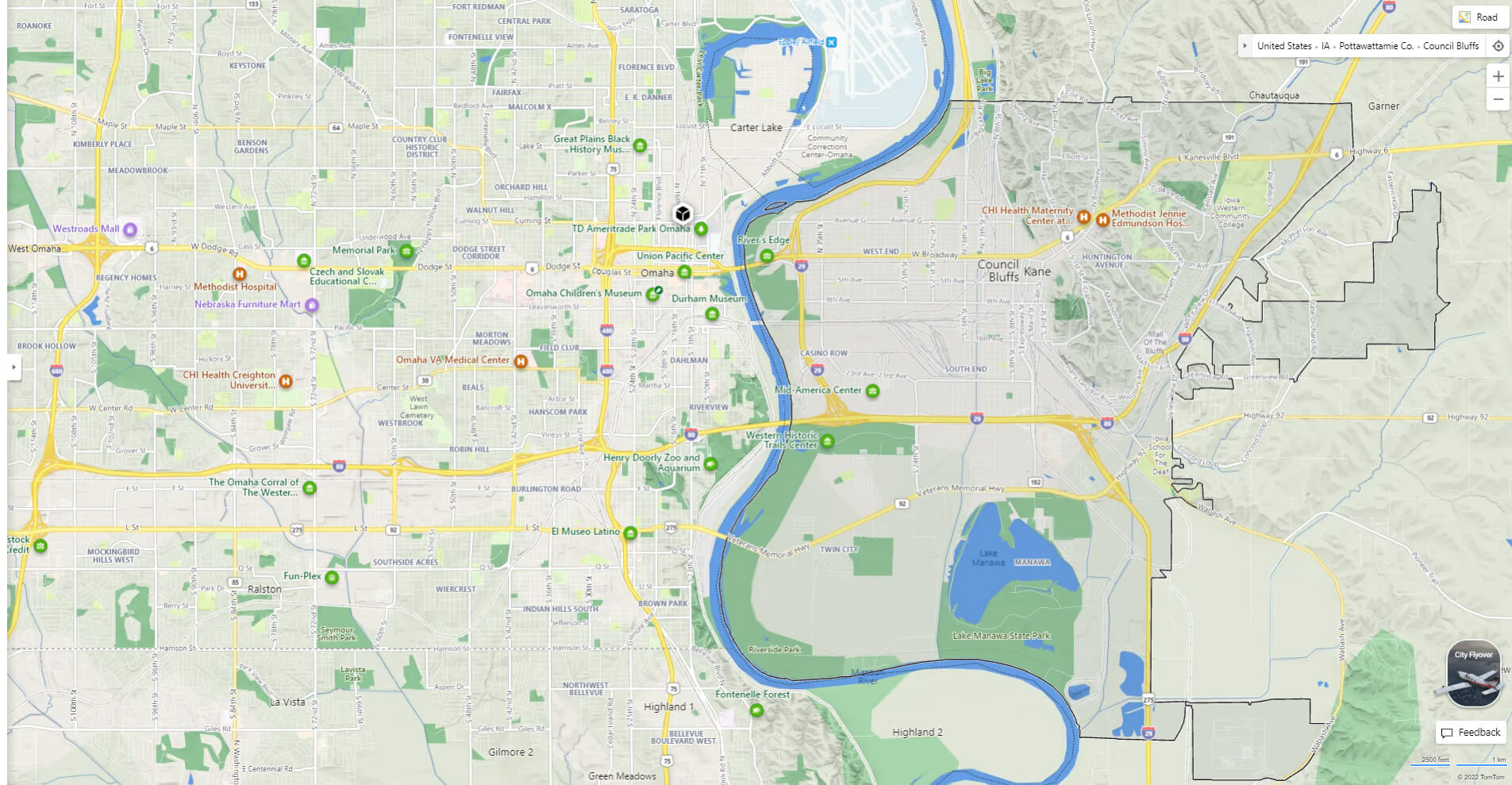

Chase’s pricing actually obviously said. Although not, the business really does remember that individuals will need to shell out closure costs on the cash-aside re-finance. These can is software costs, appraisal charge and identity costs. You may also research your potential refinancing interest levels towards Chase’s web site by typing their postcode. The fresh new cost you see won’t be real has the benefit of out of Pursue, nonetheless they can provide a sense of the overall appeal variety it’s also possible to be eligible for based on your residence’s location.

Chase financial balances

J.P. Morgan Chase was a financially secure business, because confirmed of the stable reviews it gotten from Moody’s, Standard & Poor’s and you may Fitch. A steady rating means that an institution’s economic balance actually trending upwards otherwise down it is estimated to remain the same. That is an effective signal for Pursue, which also possess feedback inside the A class from all the third-people institutions in the above list.

Leave a reply

Laisser un commentaire