Getting home financing certainly is one of him or her

Regardless if extremely steps in the home to acquire experience continue to be face-to-deal with, there are no bank account loans Fayetteville various stages in the method that can be done from your own home or office. Before you submit an online application, although not, you would certainly be smart to earliest opinion various online language resources.

Begin by thinking about online information tips that will help work through brand new maze from resource a new household. Of a lot societal and you will non-cash groups try would love to pay attention to from you.

However, you can easily still have to supply the exact same outlined economic information so you’re able to a virtual financial you to definitely a stone-and-mortar financial would want

- The new U.S. Agency out-of Property and Metropolitan Situations will bring factual statements about shopping for, capital, and remaining a house. Visit .

- InCharge Obligations Choices counsels potential homebuyers, educates and you will makes him or her into the to find procedure. Check out and select Construction Counseling in the variety of attributes, or label toll-100 % free 877-267-0595.

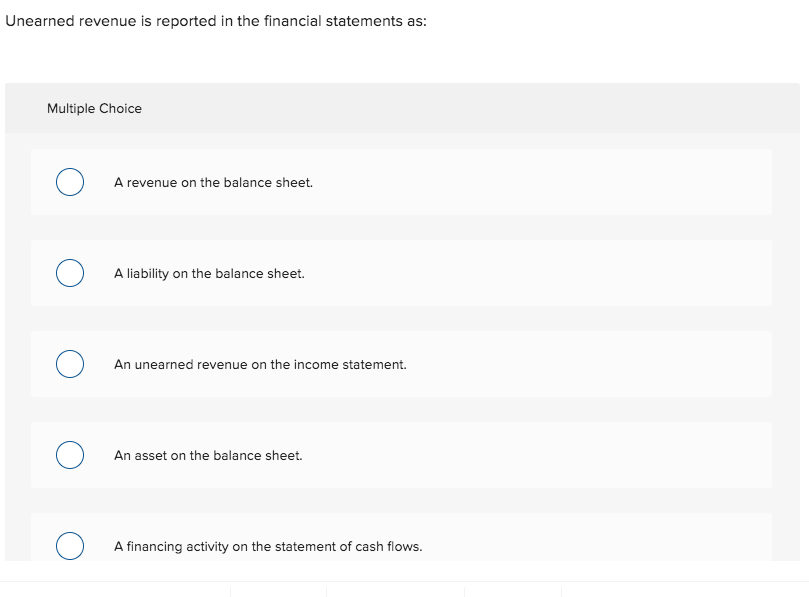

After you learn the procedure and you will terms, you will be better willing to glance at the private lenders’ websites. Online loan providers will tell you when they be involved in bodies-backed credit software. You might constantly rating interest rate estimates and mortgage pre-certification in no time.

And you’ll have to use a similar caution during the get on line mortgage products that you would use when applying face-to-face. There are numerous essential economic security things to think about just before your incorporate online for a loan:

But not, it is possible to still have to deliver the exact same in depth economic advice so you’re able to an online financial one to a stone-and-mortar bank would need

- Limit the level of apps you create. You can fill in programs and you will submit all of them with the mouse click of a beneficial mouse. But remember that a lot of apps within the a brief period of time get damage your credit rating. Unfortuitously, you’ll be able to hardly ever score a performance offer if you don’t fill out an application, but instead regarding watching the brand new rates decrease, you may also locate them rise once you have submitted loan requests to many loan providers.

- Watch out for bait and you will switch also provides. Because it sometimes happens deal with-to-deal with, you might be considering a great low interest rate on the internet, only to see the low-rate decrease prior to you go to help you closing. Although you could possibly get be eligible for most readily useful terms and conditions somewhere else, the new cyber-bank is gambling that you don’t have time to look, implement and just have accepted before your closure day. Make sure your on the internet rates try closed for the, similar to you would when dealing with a lender deal with-to-face.

- Make sure to discover in which debt analysis goes. On line con will get a lot more innovative everyday and it is not hard getting con artists in order to make glamorous, professional-looking websites. Don’t let yourself be fooled by the offers out of unbelievably lower rates out-of not familiar loan providers. Identity theft & fraud most happens an internet-based lending often makes it simple. For many who fill in a credit card applicatoin but don’t found an answer, exactly what do you do? Before you transmit your public safeguards count, bank and you can borrowing account quantity or any other personal data on the internet, verify the newest lender was genuine.

What is predatory credit?

Predatory financing are unfair, deceptive and you can/or deceptive financing. The easiest needs are individuals who aren’t advised and the ones who do maybe not look around to have financing rates and terminology. When you are people, the elderly and minorities will suffer into the greater amounts, anybody can become the sufferer out-of predatory money.

New U.S. Service off Casing and you may Metropolitan Invention has identified certain gorgeous areas a number of locations in which predatory credit was nearly crisis. Check to see if you reside near one to.

How do you protect oneself away from predatory lending? Earliest, remember that they is present. Take time to browse the a home section of your regional newspaper or search online to see what rates of interest local lenders is actually battery charging. When you find yourself given a loan, inquire in the event the mortgage terminology on offer are the most effective terms and conditions in which you meet the requirements. First and foremost, learn how to acknowledge predatory financing methods.

Leave a reply

Laisser un commentaire